Untitled Document

Could the petroleum joyride - cheap, abundant oil that has sent the global economy

whizzing along with the pedal to the metal and the AC blasting for decades - be

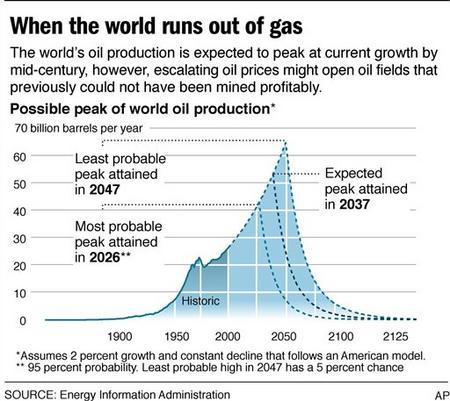

coming to an end? Some observers of the oil industry think so. They predict that

this year, maybe next - almost certainly by the end of the decade - the world's

oil production, having grown exuberantly for more than a century, will peak and

begin to decline.

And then it really will be all downhill. The price of oil will increase drastically.

Major oil-consuming countries will experience crippling inflation, unemployment

and economic instability. Princeton University geologist Kenneth S. Deffeyes

predicts "a permanent state of oil shortage."

According to these experts, it will take a decade or more before conservation

measures and new technologies can bridge the gap between supply and demand,

and even then the situation will be touch and go.

None of this will affect vacation plans this summer - Americans can expect

another season of beach weekends and road trips to Graceland relatively unimpeded

by the cost of getting there. Though gas prices are up, they are expected to

remain below $2.50 a gallon. Accounting for inflation, that's pretty comparable

to what motorists paid for most of the 20th century; it only feels expensive

because gasoline was unusually cheap between 1986 and 2003.

And there are many who doubt the doomsday scenario will ever come true. Most

oil industry analysts think production will continue growing for at least another

30 years. By then, substitute energy sources will be available to ease the transition

into a post-petroleum age.

"This is just silly," said Michael Lynch, president of Strategic

Energy and Economic Research in Winchester, Mass. "It's not like industrial

civilization is going to come crashing down."

Where you stand on "peak oil," as parties to the debate call it,

depends on which forces you consider dominant in controlling the oil markets.

People who consider economic forces most important believe that prices are high

right now mostly because of increased demand from China and other rapidly growing

economies. But eventually, high prices should encourage consumers to use less

and producers to pump more.

But Deffeyes and many other geologists counter that when it comes to oil, Mother

Nature trumps Adam Smith. The way they see it, Saudi Arabia, Russia, Norway

and other major producers are already pumping as fast as they can. The only

way to increase production capacity is to discover more oil. Yet with a few

exceptions, there just isn't much left out there to be discovered.

"The economists all think that if you show up at the cashier's cage with

enough currency, God will put more oil in ground," Deffeyes said.

There will be warning signs before global oil production peaks, the bearers

of bad news contend. Prices will rise dramatically and become increasingly volatile.

With little or no excess production capacity, minor supply disruptions - political

instability in Venezuela, hurricanes in the Gulf of Mexico or labor unrest in

Nigeria, for example - will send the oil markets into a tizzy. So will periodic

admissions by oil companies and petroleum-rich nations that they have been overestimating

their reserves.

Oil producers will grow flush with cash. And because the price of oil ultimately

affects the cost of just about everything else in the economy, inflation will

rear its ugly head.

Anybody who has been paying close attention to the news lately may feel a bit

queasy at this stage. Could $5-a-gallon gas be right around the corner?

"The world has never seen anything like this before and so we just really

don't know," said Robert L. Hirsch, an energy analyst at Science Applications

International Corp., a Santa Monica, Calif., consulting firm.

Still, he added, "there's a number of really competent professionals that

are very pessimistic."

The pessimism stems from a legendary episode in the history of petroleum geology.

Back in 1956, a geologist named M. King Hubbert predicted that U.S. oil production

would peak in 1970.

His superiors at Shell Oil were aghast. They even tried to persuade Hubbert

not to speak publicly about his work. His peers, accustomed to decades of making

impressive oil discoveries, were skeptical.

But Hubbert was right. U.S. oil production did peak in 1970, and it has declined

steadily ever since. Even impressive discoveries such as Alaska's Prudhoe Bay,

with 13 billion barrels in recoverable reserves, haven't been able to reverse

that trend.

Hubbert started his analysis by gathering statistics on how much oil had been

discovered and produced in the Lower 48 states, both onshore and off, between

1901 and 1956 (Alaska was still terra incognita to petroleum geologists 50 years

ago). His data showed that the country's oil reserves had increased rapidly

from 1901 until the 1930s, then more slowly after that.

When Hubbert graphed that pattern it looked very much like America's oil supply

was about to peak. Soon, it appeared, America's petroleum reserves would reach

an all-time maximum. And then they would begin to shrink as the oil companies

extracted crude from the ground faster than geologists could find it.

That made sense. Hubbert knew some oil fields, especially the big ones, were

easier to find than others. Those big finds would come first, and then the pace

of discovery would decline as the remaining pool of oil resided in progressively

smaller and more elusive deposits.

The production figures followed a similar pattern, but it looked like they

would peak a few years later than reserves.

That made sense too. After all, oil can't be pumped out of the ground the instant

it is discovered. Lease agreements have to be negotiated, wells drilled, pipelines

built; the development process can take years.

When Hubbert extended the production curve into the future it looked like it

would peak around 1970. Every year after that, America would pump less oil than

it had the year before.

If that prognostication wasn't daring enough, Hubbert had yet another mathematical

trick up his sleeve. Assuming that the reserves decline was going to be a mirror

image of the rise, geologists would have found exactly half of the oil in the

Lower 48 when the curve peaked. Doubling that number gave Hubbert the grand

total of all recoverable oil under the continental United States: 170 billion

barrels.

At first, critics objected to Hubbert's analysis, arguing that technological

improvements in exploration and recovery would increase the amount of available

oil.

They did, but not enough to extend production beyond the limits Hubbert had

projected. Even if you throw in the unexpected discovery of oil in Alaska, America's

petroleum production history has proceeded almost exactly as Hubbert predicted

it would.

Critics claim that Hubbert simply got lucky.

"When it pretty much worked," Lynch said, "he decided, aha,

it has to be a bell curve."

But many experts see no reason global oil production has to peak at all. It

could plateau and then gradually fall as the economy converts to other forms

of energy.

"Even in 30 to 40 years there's still going to be huge amounts of oil

in the Middle East," said Daniel Sperling, director of the Institute of

Transportation Studies at the University of California, Davis.

A few years ago, geologists began applying Hubbert's methods to the entire

world's oil production. Their analyses indicated that global oil production

would peak some time during the first decade of the 21st century.

Deffeyes thinks the peak will be in late 2005 or early 2006. Houston investment

banker Matthew Simmons puts it at 2007 to 2009. California Institute of Technology

physicist David Goodstein, whose book "The End of Oil" was published

last year, predicts it will arrive before 2010.

The exact date doesn't really matter, said Hirsch, because he believes it's

already too late. In an analysis he did for the U.S. Department of Energy in

February, Hirsch concluded that it will take more than a decade for the U.S.

economy to adapt to declining oil production.

"You've got to do really big things in order to dent the problem. And

if you're on the backside of the supply curve you're chasing the train after

it's already left the station," he said.

For example, the median lifetime of an American automobile is 17 years. That

means even if the government immediately mandated a drastic increase in fuel

efficiency standards, the conservation benefits wouldn't fully take effect for

almost two decades.

And though conservation would certainly be necessary in a crisis, it wouldn't

be enough. Fully mitigating the sting of decreasing oil supplies would require

developing alternate sources of energy - and not the kind that politicians and

environmentalists wax rhapsodic about when they promise pollution-free hydrogen

cars and too-cheap-to-meter solar power.

If oil supplies really do decline in the next few decades, America's energy

survival will hinge on the last century's technology, not the next one's. Hirsch's

report concludes that compensating for a long-term oil shortfall would require

building a massive infrastructure to convert coal, natural gas and other fossil

fuels into combustible liquids.

Proponents of coal liquefaction, which creates synthetic oil by heating coal

in the presence of hydrogen gas, refer to the process as "clean coal"

technology. It is clean, but only to the extent that the synthetic oil it produces

burns cleaner than raw coal. Synthetic oil still produces carbon dioxide, the

main greenhouse warming gas, during both production and combustion (though in

some scenarios some of that pollution could be kept out of the atmosphere).

And the coal that goes into the liquefaction process still has to be mined,

which means tailing piles, acid runoff and other toxic ills.

And then there's the fact that nobody wants a "clean coal" plant

in the backyard. Shifting to new forms of energy will require building new refineries,

pipelines, transportation terminals and other infrastructure at a time when

virtually every new project faces intense local opposition.

Energy analysts say coal liquefaction can produce synthetic oil at a cost of

$32 a barrel, well below the $50 range where oil has been trading for the past

year or so. But before they invest billions of dollars in coal liquefaction,

investors want to be sure that oil prices will remain high.

Investors are similarly wary about tar sands and heavy oil deposits in Canada

and Venezuela. Though they are too gooey to be pumped from the ground like conventional

oil, engineers have developed ways of liquefying the deposits with injections

of hot water and other means. Already, about 8 percent of Canada's oil production

comes from tar sands.

Unfortunately, it costs energy to recover energy from tar sands. Most Canadian

operations use natural gas to heat water for oil recovery; and like oil, natural

gas has gotten dramatically more expensive in the past few years.

"The reality is, this thing is extremely complicated," Hirsch said.

"My honest view is that anybody who tells you that they have a clear picture

probably doesn't understand the problem