Entered into the database on Saturday, June 03rd, 2006 @ 20:29:53 MST

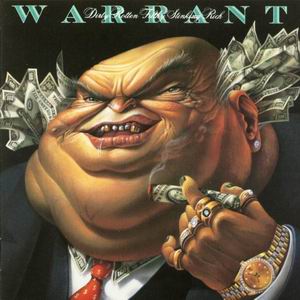

Dirty, Rotten, Filthy, Stinking Rich! The estate tax (or, The Paris

Hilton Tax) was "first adopted in the nineteenth century to fund

various wartime government revenue shortfalls" (much as we

have today), and "has been on the books continuously since

1916" when reformers were grappling with how to deal with the Gilded

Age's growing income inequality. One such reformer of that era, President Teddy

Roosevelt, said he believed in a "graduated

inheritance tax on big fortunes" because Americans "are bound

in honor to refuse to listen to those men would make us desist from the effort

to do away with the inequality, which means injustice." This year, the

exemption

level is $2 million ($4 million per couple), which means only 5

out of every 1,000 people who die will pay the estate tax. Nevertheless,

the Senate leadership soon will take up legislation to repeal the estate tax

completely in an effort to soothe its disenchanted

base. CongressDaily reported yesterday that Senate Majority Leader Bill

Frist (R-TN) could bring the bill to the floor next week, but "it is widely

expected that repeal legislation will not garner the 60 votes needed."

The decision to bring up repeal comes at a time when Americans rank terrorism,

Iraq, gas prices, and the economy as national priorities, while only 23

percent of Americans support full repeal of the estate tax. "It's

a little unseemly," estate tax opponent Senator Chuck Grassley (R-IA)

said in Katrina's aftermath, "to be talking about eliminating the estate

tax at a time when people are suffering." Given the ongoing war in Iraq

and the continuing Gulf Coast reconstruction, the Senate should heed his words. NOT A REAL COMPROMISE: Because supporters of full repeal do

not have enough votes, the Senate may take up "compromise" legislation

by Sen. Jon Kyl (R-AZ). Kyl's bill calls for a $5 million exemption level ($10

million per couple) taxed at a 15 percent rate. The current maximum rate is

46

percent on the amount over $4 million, and the average estate subject to

the tax pays only 18

percent because of the high exemption. The Kyl bill is a costly compromise.

The Center for Budget and Policy Priorities estimates the change would cost

$770

to $800 billion from 2012-2021, including interest costs, which is 80 to

84 percent as much as full repeal. A more sensible

solution would be a $5 million per couple exemption and a 45 percent rate

above that level. CBPP found that raising

the exemption level, rather than lowering the tax rate, would better target

the few farms and family-owned businesses the tax affects. THE BIRTH TAX: The right wing has been on a mission to define

the tax on inherited wealth as a "death

tax." (Michael Graetz and Ian Shapiro have documented how the right

did so in their book, "Death

by a Thousand Cuts.") While 2.4

million Americans die each year, the federal government only collects taxes

on 12,600 estates, meaning only 0.5 percent of Americans who die pay any estate

tax under this year's exemption levels. "Calling this a 'death tax' as

if it applies to all, or even many, Americans who die," writes the Brookings

Institution's Diane Lim Rogers, "is truly false advertising." Instead,

repealing the estate tax will add

thousands of dollars to the tax burden of our children and grandchildren.

(The current burden on $8.3

trillion of debt is nearly $28,000.)

Full repeal is expected to cost the government $745

billion after the first 10 years that it is in effect, and $1

trillion as interest accrues on the added debt. Rogers estimates this will

add

an additional $3,000 to the per-person debt burden. To put the $1 trillion

figure into perspective, the total

cost of the Iraq war will hit $320 billion once the Senate passes the latest

supplemental bill. And in 2005, the federal

government spent $39 billion on homeland security, $38 billion on K-12 education,

and $28.7 billion on veterans health care -- all paltry figures when compared

to the long-term cost of estate tax repeal. The money going towards repeal could

also be used to keep Social

Security solvent over 75 years. PARIS HILTON IS NOT A FARMER, SHE JUST PLAYS ONE ON TV: One

myth the right wing peddles is that the estate tax puts farmers and family-owned

business owners out of business. Forced to the pay enormous tax bills, the story

goes, farmers have to sell off the family farm to pay the tax man. The story

has been highly effective - it has "helped

convince 33 percent of Americans that every U.S. family must pay estate

taxes." But it isn't true. A Congressional Budget Office (CBO) report

looked at these claims and "exploded

the myth that family farms and businesses must be sold to pay the tax."

CBO found under the 2009 estate tax schedule ($7 million per couple), the "number

of family-owned small businesses required to pay any taxes in the year 2000

would have been just 94," and the "number of family farms that would

have had to sell any assets to pay that tax would

have been 13." THE SUPER-RICH PUSH FOR ESTATE TAX REPEAL: Those who would

benefit most are the ones pushing hardest for estate tax repeal. Passing this

massive tax cut for the super-rich would mean "830 of the best-off estates

in the country would split an estimated $14 billion in tax breaks each year,

or $16

million per estate." A recent report from Rep. Henry Waxman (D-CA)

and other members of the House Government Reform committee found that oil company

executives "are likely to receive a windfall of up to $211

million" under full repeal. Exxon

CEO Lee Raymond, who is receiving "one of the most

generous retirement packages in history," would receive a tax break

of over $160 million. President Bush, Vice President Cheney, and the Cabinet

stand to gain between

$91 million and $344 million. Some of the richest families in America are

leading the lobbying charge. Public

Citizen revealed that "18 families worth a total of $185.5 billion

have financed and coordinated a 10-year effort to repeal the estate tax, a move

that would collectively net them a windfall of $71.6 billion." These families

include "the candy magnate Mars family, Waltons of Wal-Mart fame, Kochs

of Koch Industries and Dorrance family of the Campbell’s Soup Co."

Other wealthy Americans such as Paul Newman, actor and owner of Newman's Own,

are on the opposite side of the issue. "For those of us lucky enough to

be born in this country and to have flourished here," Newman said, "the

estate tax is a reasonable and appropriate way to return something to the common

good. I’m proud to be among those supporting preservation of this tax,

which is one

of the fairest taxes we have." American Progress Report