Entered into the database on Sunday, February 26th, 2006 @ 17:45:23 MST

March 20 to 26, 2006: Iran-USA, beginning of a major world crisis,

or "the End of the Western World we have known since 1945". The Laboratoire européen d’Anticipation Politique Europe 2020,

LEAP/E2020, now estimates

to over 80% the probability that the week of March 20-26, 2006 will be the beginning

of the most significant political crisis the world has known since the Fall

of the Iron Curtain in 1989, together with an economic and financial crisis

of a scope comparable with that of 1929. This last week of March 2006 will be

the turning-point of a number of critical developments, resulting in an acceleration

of all the factors leading to a major crisis, disregard any American or Israeli

military intervention against Iran. In case such an intervention is conducted,

the probability of a major crisis to start rises up to 100%, according to LEAP/E2020.

An Alarm based on 2 verifiable events The announcement of this crisis results from the analysis of decisions taken

by the two key-actors of the main on-going international crisis, i.e. the United

States and Iran: - on the one hand there is the Iranian decision of opening the first oil

bourse priced in Euros on March 20th, 2006 in Teheran, available to all oil

producers of the region ; - on the other hand, there is the decision of the American Federal Reserve

to stop publishing M3 figures (the most reliable indicator on the amount of

dollars circulating in the world) from March 23, 2006 onward[1]. These two decisions constitute altogether the indicators, the causes and the

consequences of the historical transition in progress between the order created

after World War II and the new international equilibrium in gestation since

the collapse of the USSR. Their magnitude as much as their simultaneity will

catalyse all the tensions, weaknesses and imbalances accumulated since more

than a decade throughout the international system. A world crisis declined in 7 sector-based crises LEAP/E2020's researchers and analysts thus identified 7 convergent

crises that the American and Iranian decisions coming into effect during the

last week of March 2006, will catalyse and turn into a total crisis, affecting

the whole planet in the political, economic and financial fields, as well as

in the military field most probably too: 1. Crisis of confidence in the Dollar 2. Crisis of US financial imbalances 3. Oil crisis 4. Crisis of the American leadership 5. Crisis of the Arabo-Muslim world 6. Global governance crisis 7. European governance crisis The entire process of anticipation of this crisis is described in detail

in coming issues of LEAP/E2020’s confidential letter – the GlobalEurope

Anticipation Bulletin, and in particular in the 2nd issue to be released

on February 16, 2006. These coming issues will present the detailed analysis

of each of the 7 crises, together with a large set of recommendations intended

for various categories of players (governments and companies, namely), as well

as with a number of operational and strategic advices for the European Union. Decoding of the event “Creation of the Iranian Oil Bourse priced

in Euros” However, and in order not to limit this information to decision makers

solely, LEAP/E2020 has decided to circulate widely this official statement together

with the following series of arguments resulting from work conducted. Iran's opening of an Oil Bourse priced in Euros at the end of March 2006 will

be the end of the monopoly of the Dollar on the global oil market. The immediate

result is likely to upset the international currency market as producing countries

will be able to charge their production in Euros also. In parallel, European

countries in particular will be able to buy oil directly in their own currency

without going though the Dollar. Concretely speaking, in both cases this means

that a lesser number of economic actors will need a lesser number of Dollars

[2].

This double development will thus head to the same direction, i.e. a very significant

reduction of the importance of the Dollar as the international reserve currency,

and therefore a significant and sustainable weakening of the American currency,

in particular compared to the Euro. The most conservative evaluations give €1

to $1,30 US Dollar by the end of 2006. But if the crisis reaches the scope anticipated

by LEAP/E2020, estimates of €1 for $1,70 in 2007 are no longer unrealistic. Decoding of the event “End of publication of the M3 macro-economic

indicator” The end of the publication by the American Federal Reserve of the M3 monetary

aggregate (and that of other components)[3],

a decision vehemently criticized by the community of economists and financial

analysts, will have as a consequence to lose transparency on the evolution of

the amount of Dollars in circulation worldwide. For some months already, M3

has significantly increased (indicating that « money printing »

has already speeded up in Washington), knowing that the new President of the

US Federal Reserve, Ben Bernanke, is a self-acknowledged fan of "money

printing "[4].

Considering that a strong fall of the Dollar would probably result in a massive

sale of the US Treasury Bonds held in Asia, in Europe and in the oil-producing

countries, LEAP/E2020 estimates that the American decision to stop publishing

M3 aims at hiding as long as possible two US decisions, partly imposed by the

political and economic choices made these last years[5]: . the ‘monetarisation’ of the US debt . the launch of a monetary policy to support US economic activity. … two policies to be implemented until at least the October 2006 "mid-term"

elections, in order to prevent the Republican Party from being sent in reeling. This M3-related decision also illustrates the incapacity of the US and international

monetary and financial authorities put in a situation where they will in the

end prefer to remove the indicator rather than try to act on the reality. Decoding of the aggravating factor “The military intervention

against Iran” Iran holds some significant geo-strategic assets in the current crisis, such

as its ability to intervene easily and with a major impact on the oil provisioning

of Asia and Europe (by blocking the Strait of Ormuz), on the conflicts in progress

in Iraq and Afghanistan, not to mention the possible recourse to international

terrorism. But besides these aspects, the growing distrust towards Washington

creates a particularly problematic situation. Far from calming both Asian and

European fears concerning the accession of Iran to the statute of nuclear power,

a military intervention against Iran would result in an quasi-immediate dissociation

of the European public opinions[6]

which, in a context where Washington has lost its credibility in handling properly

this type of case since the invasion of Iraq, will prevent the European governments

from making any thing else than follow their public opinions. In parallel, the

rising cost of oil which would follow such an intervention will lead Asian countries,

China first and foremost, to oppose this option, thus forcing the United States

(or Israel) to intervene on their own, without UN guarantee, therefore adding

a severe military and diplomatic crisis to the economic and financial crisis. Relevant factors of the American economic crisis LEAP/E2020 anticipate that these two non-official decisions will

involve the United States and the world in a monetary, financial, and soon economic

crisis without precedent on a planetary scale. The ‘monetarisation’

of the US debt is indeed a very technical term describing a catastrophically

simple reality: the United States undertake not to refund their debt, or more

exactly to refund it in "monkey currency". LEAP/E2020 also anticipate

that the process will accelerate at the end of March, in coincidence with the

launching of the Iranian Oil Bourse, which can only precipitate the sales of

US Treasury Bonds by their non-American holders. In this perspective, it is useful to contemplate the following information[7]:

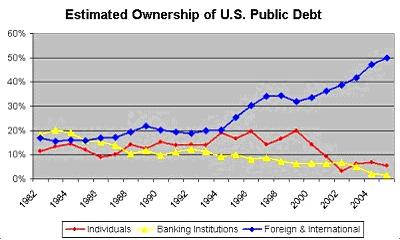

the share of the debt of the US government owned by US banks fell down to 1,7%

in 2004, as opposed to 18% in 1982. In parallel, the share of this same debt

owned by foreign operators went from 17% in 1982 up to 49% in 2004. Question: How comes that US banks got rid of almost all their share of the

US national debt over the last years? Moreover, in order to try to avoid the explosion of the "real-estate bubble"

on which rests the US household consumption, and at a time when the US saving

rate has become negative for the first time since 1932 and 1933 (in the middle

of the "Great Depression"), the Bush administration, in partnership

with the new owner of the US Federal Reserve and a follower of this monetary approach,

will flood the US market of liquidities. Some anticipated effects of this systemic rupture According to LEAP/E2020, the non-accidental conjunction of the Iranian

and American decisions, is a decisive stage in the release of a systemic crisis

marking the end of the international order set up after World War II, and will

be characterised between the end of March and the end of the year 2006 by a

plunge in the dollar (possibly down to 1 Euro = 1,70 US Dollars in 2007) putting

an immense upward pressure on the Euro, a significant rise of the oil price

(over 100$ per barrel), an aggravation of the American and British military

situations in the Middle East, a US budgetary, financial and economic crisis

comparable in scope with the 1929 crisis, very serious economic and financial

consequences for Asia in particular (namely China) but also for the United Kingdom[8],

a sudden stop in the economic process of globalisation, a collapse of the transatlantic

axis leading to a general increase of all the domestic and external political

dangers all over the world. For individual dollar-holders, as for trans-national corporations or political

and administrative decision makers, the consequences of this last week of March

2006 will be crucial. These consequences require some difficult decisions to

be made as soon as possible (crisis anticipation is always a complex process

since it relies on a bet) because once the crisis begins, the stampede starts

and all those who chose to wait lose. For private individuals, the choice is clear: the US Dollar no longer is a “refuge”

currency. The rising-cost of gold over the last year shows that many people

have already anticipated this trend of the US currency. Anticipating… or being swept away by the winds of history For companies and governments, it is crucial to integrate now action plans

in today's decision-making processes, which can contribute to soften significantly

the "monetary, financial and economic tsunami" which will break on

the planet at the end of next month. To use a simple image – by the way,

one used in the political anticipation scenario "USA 2010" [9]

-, the impact of the events of the last week of March 2006 on the “Western

World” we have known since 1945 will be comparable to the impact of the

Fall of the Iron Curtain in 1989 on the “Soviet Block”. If this Alarm is so precise, it is that LEAP/E2020’s analyses

concluded that all possible scenarios now lead to one single result: we collectively

approach a "historical node" which is henceforth inevitable whatever

the action of international or national actors. At this stage, only a direct

and immediate action on the part of the US administration aimed at preventing

a military confrontation with Iran on the one hand, and at giving up the idea

to monetarise the US foreign debt on the other hand, could change the course

of events. For LEAP/E2020 it is obvious that not only such actions

will not be initiated by the current leaders in Washington, but that on the

contrary they have already chosen "to force the destiny" by shirking

their economic and financial problems at the expense of the rest of the world.

European governments in particular should draw very quickly all the conclusions

from this fact. For information, LEAP/E2020's original method of political anticipation

has allowed several of its experts to anticipate (and publish) in particular

: in 1988, the approaching end of the Iron Curtain; in 1997, the progressive

collapse in capacity of action and democratic legitimacy of the European institutional

system; in 2002, the US being stuck in Iraq’s quagmire and above all the

sustainable collapse of US international credibility; in 2003, the failure of

the referenda on the European Constitution. Its methodology of anticipation

of "systemic ruptures" now being well established, it is our duty

as researchers and citizens to share it with the citizens and the European decision

makers; especially because for individual or collective, private or public players,

it is still time to undertake measures in order to reduce significantly the

impact of this crisis on their positions whether these are economic, political

or financial.