Entered into the database on Monday, July 11th, 2005 @ 01:28:18 MST

The drug industry's huge investments in Washington—though meager compared

to the profits they make—have paid off handsomely, resulting in a series

of favorable laws on Capitol Hill and tens of billions of dollars in additional

profits. [See What the Industry Got.] They have also fended off measures aimed

at containing prices, like allowing importation of medicines from countries

that cap prescription drug prices, which would have dented their profit margins.

Pfizer, the world's largest drug company, made a profit of $11.3 billion last

year, out of sales of $51 billion. The industry's multi-faceted influence campaign has also led to a more industry-friendly

regulatory policy at the Food and Drug Administration, the agency that approves

its products for sale and most directly oversees drug makers. [See FDA: A Shell

of its Former Self] Most of the industry's political spending paid for federal lobbying. Medicine

makers hired about 3,000 lobbyists, more than a third of them former federal

officials, to advance their interests before the House, the Senate, the FDA,

the Department of Health and Human Services, and other executive branch offices.

In 2003 alone, the industry spent nearly $116 million lobbying the government.

That was the year that Congress passed, and President George W. Bush signed,

the Medicare Modernization Act of 2003, which created a taxpayer-funded prescription

drug benefit for senior citizens. That figure was not anomalous. In 2004, drug makers upped their reported expenditures

on lobbyists to $123 million, a record amount for the industry. Of the 1,291

lobbyists who were listed that year as prepresenting pharmaceutical corporations

and their trade groups, some 52 percent were former federal officials. By adding the benefit to Medicare, the government program that provides health

insurance to some 41 million people, the industry found a reliable purchaser

for its products. Thanks to a provision in the law for which the industry lobbied,

government programs like Medicare are barred from negotiating with companies

for lower prices. Critics charge that the prescription drug benefit will transfer wealth from

taxpayers, who provide the funding for Medicare, to pharmaceutical firms. According

to a study done in October 2003 by Boston University professors Alan Sager and

Deborah Socolar, 61 percent of Medicare money spent on prescription drugs will

become profit for drug companies. Drug-makers will receive $139 billion in increased

profits over eight years, the study predicts. The Medicare prescription drug

benefit starts in 2006. America the lucrative Many blame the industry's clout in Congress and with the executive branch for

the high price of drugs. While many governments worldwide have regulated drug

prices, the industry has been able to block a host of measures aimed at controlling

prices in the United States. In the past few years, the industry has mounted

an effective, organized campaign against legalizing importation of drugs from

Canada. As the Center reported in January, the industry trade group, Pharmaceutical

Research and Manufacturers of America, hired a former U.S. ambassador to Canada,

Gordon Giffin, and his top aide to lobby the Canadian government on the issue.

The industry's pressure may be paying off. Last week, Canadian Health Minister

Ujjal Dosanjh announced that his government would ban the bulk export of prescription

drugs and crack down on Internet pharmacies that sell drugs to Americans. A spokesman for PhRMA, Jeff Trewitt, told the Center in January that price

controls thwart innovation and importation of drugs pose serious health risks.

The top 20 drug corporations and the industry's two trade groups, PhRMA and

the Biotechnology Industry Organization, which represents biomedicine companies,

disclosed lobbying on more than 1,600 bills between 1998 and 2004. They may

have lobbied on far more bills; the Center could only count bills specifically

mentioned by the companies and trade groups in their filings. In many cases,

lobbyists list issues, like "animal health issues," rather than specific

bills. In counting the number of bills, the Center excluded those lobbied on

by BIO that relate solely to biotechnology issues, such as genetically engineered

foods. Apart from Congress, the industry lobbied an array of agencies including the

Department of Health and Human Services, the Food and Drug Administration and

the State Department on dozens of issues. For instance, PhRMA lobbied 33 federal

agencies on 39 issues separately identified under the Lobbying Disclosure Act

of 1995. As the Center reported last week, the agencies include the Office of the U.S.

Trade Representative, which shapes the country's trade agreements with other

nations. Since 1998, it has filed 59 lobbying reports concerning the USTR, more

than any other lobby or interest. In recent years, the industry has shown significant power in influencing U.S.

trade policy. For example, current drafts of the Dominican Republic-Central

American Free Trade Agreement reflect PhRMA's desire to remove price controls

on drugs and provide intellectual property protection in proposed member countries.

Recently, the USTR, at the behest of the pharmaceutical industry, pressured

Guatemala into repealing a recently passed law permitting wider marketing of

generic drugs. The top 20 corporations and the trade groups reported spending nearly $478

million on lobbying, or nearly 70 percent of all the money the industry reported.

These corporations had roughly 64 percent of the global market share, according

to IMS Health, a private consulting company that studies the industry. Congress is most frequently listed as a target of the industry's lobbying attentions;

contacts with the House or Senate are listed on about 5,500 lobby disclosure

reports. The Department of Health and Human Services, the Centers for Medicare

and Medicaid Services, the Food and Drug Administration and the Executive Office

of the President are other agencies heavily lobbied by the industry. Like other well connected interests in Washington, pharmaceutical firms look

to former insiders to carry their message to Congress and executive branch officials.

In May 2003, as the battle over the Medicare legislation was climaxing, the

Pharmaceutical Research and Manufactures of America, the industry trade group,

hired the newly formed lobby shop of Larson Dodd, LLC to join its already formidable

army of representatives swarming the hallways of Congress. The hiring of Dave

Larson and Quin Dodd by PhRMA—and later by Wyeth and other drug manufactures—was

in keeping with the industry's standard operating procedure: employing former

officials to lobby on bills sponsored by their ex-bosses. Larson was a health policy advisor to Senate Majority Leader Bill Frist, the

chief sponsor of a Medicare bill that, six months later, would become law, with

potentially tens of billions of dollars of windfall for the drug companies.

Dodd is a former legislative director to Sen. Kay Bailey Hutchison, the fourth

ranking Republican in the upper chamber. A third of all lobbyists employed by the industry are former federal government

employees, including more than 15 former Senators and more than 60 former members

of the U.S. House of Representatives. The two trade groups, PhRMA and BIO, are

headed by two influential former members of Congress. PhRMA chief Billy Tauzin

and BIO president Jim Greenwood were on committees that regulated drug companies

and they each sponsored several bills related to the industry. The Center reviewed the 1,600 plus bills the top 20 drug corporations and PhRMA

and BIO lobbied. Sponsors of more than 50 percent of those bills had one or

more former staff members representing the industry. A few of the sponsors have

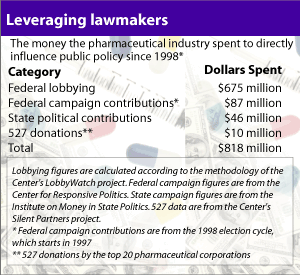

gone on to become lobbyists themselves. Political giving Nearly $87 million of the contributions went to federal politicians in campaign

donations, with almost 69 percent going to Republican candidates. Top recipients

of the industry's campaign money include President George W. Bush (upwards of

$1.5 million) and members who sit on committees that have jurisdiction over

pharmaceutical issues. In the states, the industry gave more than $46 million to candidates since

'98, according to the Institute on Money in State Politics, which tracks campaign

finance at the state level. The Center could not determine the amount drug interests spent on lobbying

in states because of the lack of comparable state disclosure requirements for

expenditures. But their lobbying, campaign donations and grassroots efforts

have taken on an added dimension because many states are threatening the industry's

high profit margins in a way the federal government and Congress have been unwilling

to do. With states running into fiscal crises, several governors and legislatures

have been exploring ways to contain drug prices. Among the several options that

have been considered around the country include allowing seniors and others

to legally buy drugs from Canada and other countries. Though some states have been less amenable to drug industry pressure, the drug

industry hasn't given up the fight. For Washington's biggest spending lobby,

it's a small investment to make for its continuing prosperity.

The U.S. government contributes more money to the development of new drugs—in

the form of tax breaks and subsidies—than any other government. Of the

20 largest pharmaceutical corporations, nine are based in the United States.

Yet drugs are more expensive in the United States than in any other part of

the world, and global drug companies make the bulk of their profits in the United

States.

Marketing Maladies

More than a third of pharmaceutical companies' resources go into promotion

and marketing.

Company

Marketing costs

Research and Development

$16.90 billion

$7.68 billion

$12.93 billion

$5.20 billion

$5.59 billion

$9.26 billion

$15.86 billion

$5.20 billion

$7.35 billion

$4.01 billion

$8.87 billion

$4.21 billion

$7.84 billion

$3.80 billion

$7.24 billion

$4.01 billion

$6.43 billion

$2.50 billion

$5.80 billion

$2.46 billion

$4.92 billion

$1.70 billion

Annually, the industry spends up

to $60 billion on drug marketing—nearly twice what it spends on research

and development. In 2004, Pfizer spent almost $120 million for media ads

for Lipitor, the world's number-one selling prescription drug, while companies

promoting erectile dysfunction treatments Viagra, Levitra and Cialis spent

$425 million. Direct to consumer advertisement has also grown significantly:

from $791 million in 1996 to $3.8 billion in 2004.

Lobbying numbers since 1998

Amount spent on lobbying

$675 million

Lobbyists

3,009

Former officials who registered to lobby

1,014

Former members of Congress who lobbied

75

Bills lobbied

More than 1,600

In addition to hiring former members and their staffs, the industry has also

helped keep lawmakers in office by making political contributions. Since the

1998 election cycle, employees of the pharmaceutical and health product industry,

their family members and industry political action committees have given $133

million in campaign contributions to candidates running for federal and state

offices, according to the Center for Responsive Politics. Since 2000, the top

drug corporations and their employees and PhRMA gave more than $10 million to

527 organizations, tax-exempt political committees which operate in the grey

area between federal and state campaign finance laws.

Victoria Kreha, Alexander Cohen, Kevin Boettcher and Emily McNeill contributed

to this report.